Manager Update - Q2 2019

18.07.2019—

Dear Readers,

Financial markets continue their rally this quarter, with the S&P 500 up a further 3.8% bringing YTD returns to 17.2%. In comparison, the MSCI World Equity market index has been flat in the 2nd quarter, with YTD performance standing at 11.3%. Evidently, the US equity market is still benefiting from the Trump effect, outperforming global markets by a wide margin. How sustainable this is when geopolitical risks seem to be on a continuous rise, is the million-dollar question.

Q2 ART AUCTIONS

In the art market, sentiment in the second quarter seems to have been boosted thanks to the strong Asia auctions in early April, the Venice Biennale and Art Basel, and the big news that Sotheby’s was being privatized by French/Israeli media-tech billionaire Patrick Drahi. The final series of auctions in London in June started with a weak showing at the Christie’s Impressionists sale that was dwarfed by a strong showing at Sotheby’s Impressionist sale the following day (probably too early to call this the Drahi effect, however). The Contemporary sales had superb sell-through rates as Christie’s returned with a strong evening sale after skipping the evening sale last summer. Overall, however, combined contemporary sale results at Sotheby’s, Christie’s and Phillips were relatively weak as the total turnover of GBP 126 million barely made the low estimate of GBP 125 – 180 million for the auction season, with overall auction turnover up a minor 2.3% vs 2018.

SALES ACTIVITY & FUND PERFORMANCE

In the second quarter, we increased the pace of sales. In our last newsletter, we reported first quarter sales (to April 3) of 15 works for $774’000. In the second quarter we realized a further 26 works for $1’581’000 bringing YTD sales to $2.35 million and since inception total sales to $9.7 million. In terms of performance, the 2nd quarter was better with Gross IRR for 2019 sales increased from 7.5% in Q1 to 9.8% in Q2, averaging just above 9% YTD. Premium to book value also increased from 17% in Q1 to 18.5% in Q2, with an average of 18% YTD (higher than our since inception average of 14%), reasserting our observation that the 2018 valuation was extremely conservative. The premium to book value does not account for auction house commissions of 25% that should be added to the works sold at auction, meaning the valuation was circa 40% below the price buyers were actually willing to pay for the 41 works sold in 2019.

‘Anti-Entropy’ by William Kentridge, 'Baston di Kabunian’ by Rodel Tapaya and ‘Adinsibouli Stood Tall’ by El Anatsui

Our 3 major sales in the second quarter were:

- ‘Anti-Entropy’ by William Kentridge, which despite being offered on the heels of the artist’s broadly acclaimed exhibition at the Kunstmuseum during Art Basel; achieving a new world auction record for a work on paper a day earlier at Sotheby’s; appearing on the back cover of the Phillips auction catalog and being heavily promoted online in the run-up to the sale - eventually hammered down at a disappointing GBP 300’000 (c. $ 424’000 inclusive of buyer’s premium) to a single bidder, below its pre-sale estimate of GBP 320-450’000, representing an IRR of only 6.75% for the fund. This disappointing result was followed by several other disappointments for works we consigned to the Phillips day sale which ended up having the highest buy-in rate of the season which stood at 24% of lots, versus 20% at the equivalent Sotheby’s sale and only 8% at Christie’s. Evening sale buy-in rates were far better at 11%, 10%, and 9% respectively.

- 'Baston di Kabunian’ by Rodel Tapaya, an award-winning monumental painting by the emerging Filipino artist that we have been championing since 2011, which achieved a new auction record for the artist and for any Contemporary artwork sold in the Philippines. The work sold at Salcedo auctions in Manila for 19’856’000 Philippine Pesos, or about $388’000, generating a Gross IRR of c. 34% for the fund over the 8 year period. We paid $30’000 for this work and are netting c. $330’000, making it our second most profitable investment to date in terms of both absolute profit and % returns – in excess of $300’000 and 1000% respectively.

- ‘Adinsibouli Stood Tall’ by El Anatsui, a beautiful full figure wood sculpture from 1995, that we sold privately, for double our cost price, achieving a healthy IRR of 21%.

On a since inception basis, our realized track record comprises 107 works sold for $9.7 million. The cost for these works was $6.3 million, on average our investment in these works generated a 53% profit. Average IRR is 14.88% Gross of Fees. The realized value is 14% higher than the book value of the works at the time of sale, indicative of cautious valuations.

For those interested in full details about our sales, we are pleased to launch a new sales report, called UNMASKED, that for the first time reveals real-life statistics on investment returns on a professionally managed art investment portfolio, pushing forward our agenda for more transparency and accountability in the art world.

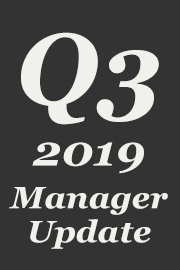

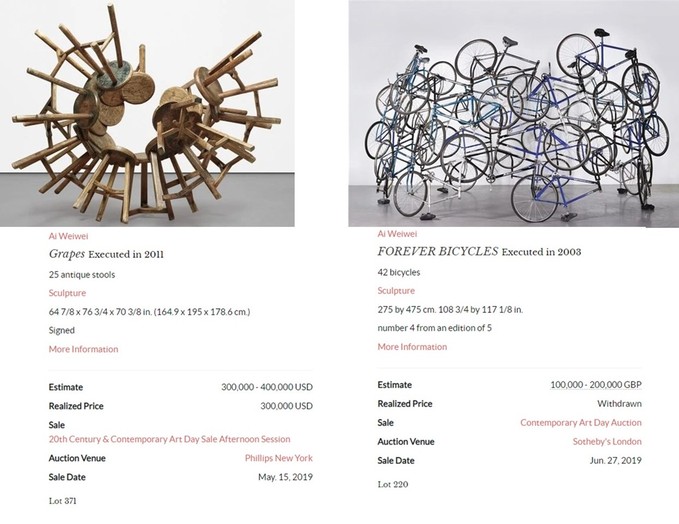

The flip side to our solid sales performance this quarter is Ai Weiwei… again. We own two important works by the artist: Forever from 2003 and Grapes from 2008. These works were the source of our strong performance in the fund between 2011 and 2014, achieving a collective valuation of $3.3 million in Dec 2014. In Oct 2015 we revalued them down by approximately 50% based on a week auction result for another edition of Forever in Hong Kong. This quarter we are faced with another markdown due to the poor performance of 2 comparable works by Weiwei at auction. Another version of Forever was withdrawn from the Sotheby’s June auction in London on the back of an estimate of GBP 100’000-150’000; and a larger Grapes work with 25 stools (ours has 10) sold for $300’000 including the 25% buyer’s premium at Phillips NY in May. The Board has therefore decided to be cautious, taking a revaluation reserve on our two works: down to $250’000 for Grapes (May NAV) and $500’000 for Forever (June NAV). These revaluation reserves will offset all the gains on the realized works, and then some, resulting in negative NAVs.

In parallel to our sales activity, we continued work on our in-depth review of storage solutions around the world, looking to streamline operational costs. We are about halfway through this review and are already generating some savings while hoping more can be done to cut costs for the remaining lifetime of the fund.

The esteemed Selection Committee gathered in London on June 7 From the left: Shaune Arp (Gagosian), Melita Skamnaki (Double Decker), Kenny Schachter (Journalist Artnet), Simon de Pury (Auctioneer, Collector, DJ), Federica Beretta (Opera Gallery), Stephanie Manasseh (ACAF Founder and Director), John Volleman (Art and Design Dealer), Wilhelm Finger (Double Decker), Serge Tiroche (Collector and Art Fund Manager), Sophie Clauwaert (Director Art Expert), Frédéric de Senarclens (ArtMarketGuru) and Sylvain Levy (DSL Collection).

June was particularly busy with 2 trips to London, the first to participate in the jury of the Accessible Art Fair taking place in Brussels in October, and the second for the auction week. I also spent several days between Zurich and Basel around the fair. In Basel, we sold the Anatsui sculpture from Goodman Gallery’s booth and I used the opportunity for several face to face meetings with galleries to try to place several other works from the collection for private sale.

We anticipate Q3 sales to be much slower with no significant auctions taking place before October and most dealers and galleries away for the summer.

WORKS FROM THE COLLECTION CURRENTLY ON MUSEUM LOANS:

- Three works by Turiya Magadlela, He is reborn into you; Identify Michael, 2012; She went all around the world and came back here #2, 2012. On view at Museum of African Contemporary Art Al Maaden – MACAAL through August 15, 2019.

- Two works by Rina Banerjee, With breath Taking Consumption Her Commerce Ate While She Was Being Eaten, 2008; Winter's Flower, 2010. On view at the San José Museum of Art. On view through August 25, 2019.

- One work by Firelei Báez, Ciguapa Pantera (to all the goods and pleasures of this world), 2015. On view at the Rockbund Art Museum through October 6, 2019.

We will take advantage of the summer to work on placements and private sales for the fall and winter seasons.

I look forward to reporting further on those efforts in our next newsletter and remain, as always, available to answer any questions.

Best regards and I hope you enjoy a relaxing summer and quality time with your loved ones.

Serge Tiroche, Co-founder

news archive

Artist Spotlight: Sigalit Landau

Oct. 8, 2014—Following the acquisition of two more works from her recent exhibition ‘Knafeh’ at Marlborough Contemporary and her forthcoming solo exhibition ‘Phoenician Sand Dance’ at Museu d’Art Contemporani de Barcelona, it is only fitting to spotlight Israeli artist Sigalit Landau, whomwe've been collecting since 2011.

Manager Update - Q3 2019

Oct. 26, 2019—A quarterly update by Serge Tiroche about the state of the art market and activities of the Tiroche DeLeon Collection.

Read More »Tiroche DeLeon Collection at Gwangju Biennale

Sept. 7, 2014—Work by Rodel Tapaya is currently being exhibited at the Gwangju Biennale.

Read More »