Manager Update - H1 2020

01.07.2020—

Dear readers,

"Puzzled!" best summarizes my feeling about the world in the past 6 months. From a global over-reaction to the COVID-19 pandemic that has resulted in a rapid reversal of decades of economic and political “globalization” and “collaboration”, to complete negligence by policymakers, led by the US Fed, to prepare for the social and economic consequences – evidenced by spiraling global unemployment and social unrest.

Despite the economic fallback being quite evident, after initially dropping 34% between February 19 and March 23, the S&P 500 has since recovered 75% and is down a meager 9% from its all-time February high. The Tech-heavy NASDAQ on the other hand dropped 30% in the same period but regained 108% of its drop and is now hovering at a new all-time high above 10’000.

How can this be explained? To me it’s nothing other than a massive manipulation by a government that seems to think it can print endless money without consequence, growing the divide between rich and poor, and leading astray a huge middle-class that lives in Lalaland – relying on their stock market savings/gains as a source of living. When payday comes the damage will be immense. That said, I really hope I am found wrong again.

The major effect on the art market has been a large drop in volumes and a turbocharged transition to online. The art fair industry has taken a pause and is unlikely to start to recover for months to come. It will take years before art events in general – fairs, live auctions, biennales, gallery openings, etc… - return to similar levels of activity as seen before. Thanks to technological advances, galleries were able to move a lot of activity online, as did some art fairs. As I write this, Sotheby’s just completed the first major globally coordinated online evening sale event, effectively utilizing a number of technologies, that generated $363 million of sales thanks to a remarkable selection of works. Led by an $85 million Francis Bacon triptych the marquee sale resulted in multiple auction records and sell-through rates above 90%. The Christie’s “ONE” auction will take place on July 10th as a globally coordinated cross-category event bridging online technologies with the physical auction experience taking place simultaneously in 4 locations – NY, HK, Paris, and London.

_large.jpg)

A new era for marquee auctions Sotheby's Online Evening Sale June 2020. Image Credit: Sotheby's.

On our end, the timing could not be worse. The last 2 years of the fund, 2020 and 2021, are our selling down period. Unfortunately, with auction house conservatism, reduced distribution options, and an overall drop in trade volumes, it will be difficult to sell many of the 380 or so works remaining in the collection within that time frame. So in parallel to continuing to work on finding selling opportunities, we have also been working with the Fund’s Board to devise an in-specie redemption process which allows us to avoid forced sales and allows our investors to own outright those works they wish to hold on to for personal enjoyment and/or for the eventual sale when the markets recover and/or when the promising young artists we collected are auction ready. Initial conversations with investors are very positive and we hope to roll out the process early in H2 and see a number of in-specie redemptions take place before the end of the year.

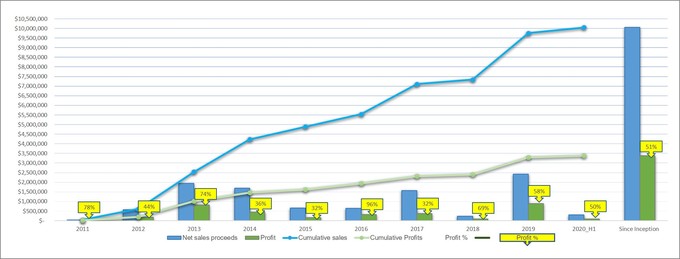

Art Vantage PCC Limited - Cumulative sales and profits on realized artworks [Gross]

Fortunately, we stepped up our selling activity already in 2019 by realizing 50 works for about $2.5 million. In the first half of 2020, we realized an additional 15 works for almost $300’000 and are working on a number of consignments for the second half. Despite the circumstances, we hope to match 2019 in terms of realizations in 2020. Please see our H1 unmasked report and below a chart of our realizations and other sales statistics to date.

African Contemporary Art Collaboration with Lempertz Auction House.

And lest I forget, I managed to squeeze in some “normal” activity before the pandemic hit and visited Brussels in January for Brafa and BRUNEAF fairs as well as our first collaboration with Lempertz auction house, which recently culminated with the successful sale of several works from our African collection. In early February I traveled to Cape Town for the local art fair and new triennial which as always was a real treat – including my last party attendance before the new order.

Artists party at the Leridon residence in Constancia, some 300+ artists from all over the continent.

From Left to right: Mongezi Ncaphayi, Elana Brundyn, Pieter Hugo, and Serge Tiroche.

As I said earlier, I am nervous about the rest of this year but hopefully, I am mistaken and somehow we achieve a “flattened curve” for the global economy.

Best wishes for now,

Serge Tiroche, co-founder

news archive

Ruben Pang "Transfiguration" Exhibition Opening

July 2, 2015—The Tiroche DeLeon Collection and STRAT are delighted to introduce Singapore artist Ruben Pang for the

inaugural exhibition of their Israel residency program.

Art Vantage PCC Limited on Bloomberg

Sept. 1, 2013—We're proud to announce that the fund has been listed to Bloomberg

Read More »Artist spotlight: Jigger Cruz

Oct. 9, 2015—Having recently acquired a third work by Jigger Cruz, the Tiroche DeLeon Collection is delighted to dedicate this spotlight to one of the rising stars of the South Asian contemporary art market.

Read More »