Tiroche DeLeon Collection 2014 Performance

06.04.2015—

Based on an independent valuation conducted by Gurr Johns, performance for 2014 was 4.99% net of all operating costs, management fees and performance fees. As of Dec 31, 2014 the collection was valued at $20,498,850.

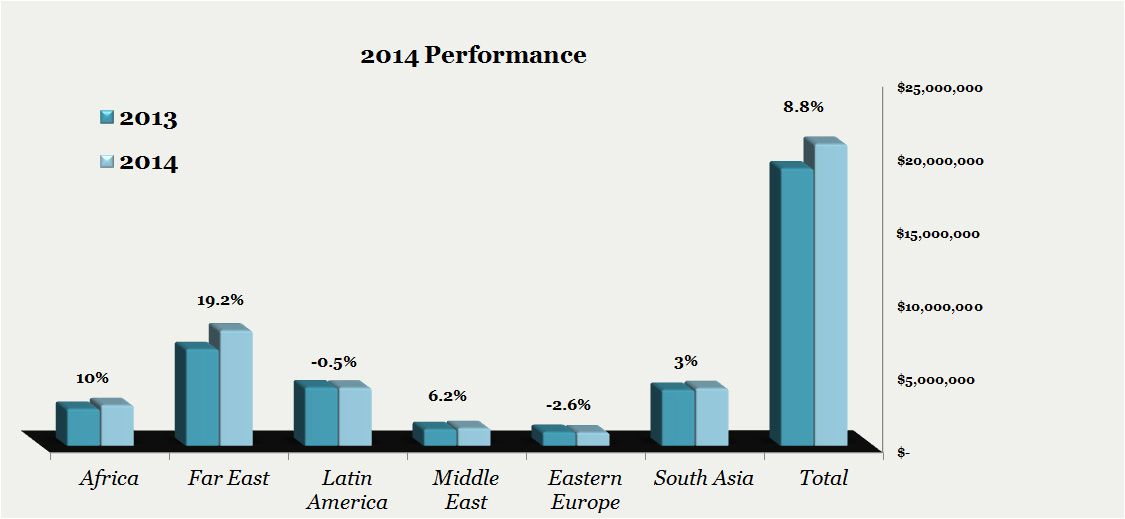

The art portfolio increased by 8.8% this year, by more than $3 million. After all operating expenses, management fees and performance fees the net investor return was 4.99%. Despite being a stretch away from our long term return objectives for fund investors, the net performance was well ahead of all performance benchmarks with the exception of Real Estate. The Skate's Art Stock index was down almost 26% for the year whereas the Hedge Fund Index (HFRI) was up only 3.36%. We remain optimistic that the artworks carry a lot of value that is not surfaced in the valuations. Our view is supported by the fact that our realized portfolio has on average exceeded book values at the time of sale by a substantial 17%.

![]()

Contribution Analysis

In terms of regional contribution, the majority of our profit came from our largest portfolio, the Far East, whose weight has risen to 38% of the overall art portolio (see below pie charts). The 19.2% rise in 2014 was in large part due to a further upward revision of the fund's 2 biggest holdings - "Forever" and "Grapes" by Ai Weiwei. Both works were on Museum loans for most of the year and Weiwei's auction results have been particularly strong for the more rare and substantial works. His circle of Zodiac signs achieved $4.4 million at a Phillips auction in February 2015, a new world record for the artist at auction. Our two works now account for almost 16% of the fund's assets, a concentration that was discussed extensively at the fund's latest board meeting, who unanimously voted to maintain our Weiwei exposure, where significant further upside is envisaged. Despite the upward revision, the new book values of $ 2.2 and 1.1 Million, respectively, remain conservative given the signficance of both pieces in the artist's oeuvre, their scale and their exhibition history.

Africa also performed well with a 10% year on year gain. Overall allocation declined to 13% as a result of the sale of a significant work by El Anatsui which produced a 60% IRR and sold at more than 15% above our book value at the time of sale.

With an allocation of roughly 20% each, our Latin America and South Asia portfolios produced dissapointing results by being more or less flat in 2014. In the Latam portfolio we believe this is a result of stabilizing prices in the auction market for established artists, whereas the younger generation (which is well represented in our collection) has not yet established an auction market. Valuers therefore lack a necessary validation of the rising prices in the primary market for these artists, and therefore rely on our original acquisition prices. In the South Asia portfolio, the continued softness in the Indian Contemporary art market masks strong performance in South Asian markets such as the Philippines, Indonesia and Singapore on which we have been placing more emphasis in the last 2 years.

![]()

Portfolio Allocation

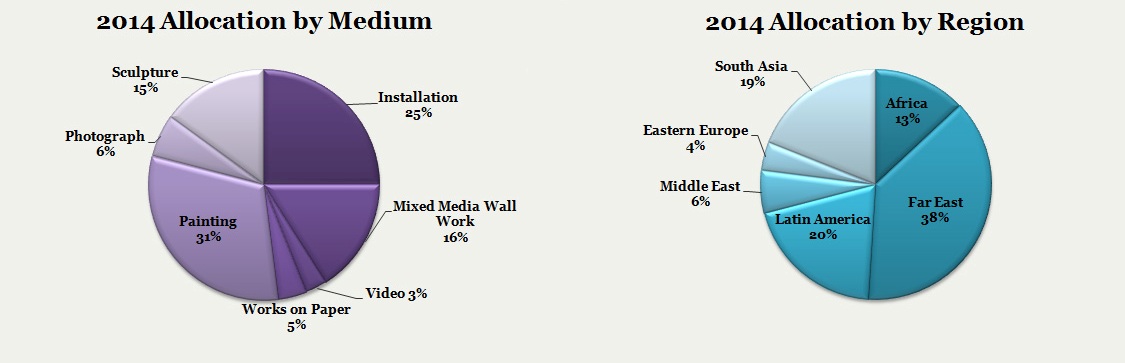

From a medium perspective, painting remains our largest allocation with 31%, followed by installation at 25%. Installations are very much a medium of the present day and one which we pay particular attention to. Artists often use this medium for their most ambitious and significant works that are most sought after for museum loans, but we are also aware of the siginificant holding costs and the limitations that scale places on resale values. We try to straddle the two in our selections.

![]()

Activity Report

We acquired 93 works in 2014 at an average price of just over $34'000, investing almost $3.2 million. We continued our strategy of selecting a number of established artists at the core, investing over 40% of our budget in only 5 works. The remaining 60% were all on acquisitions below the $100'000 threshhold.

From a regional stanpoint, 46% of acquisitions were in the Far East, 23.6% in Latam and 13.3% in Africa, 11.1% went to South Asia and the remaining 6% to the Middle East.

There were a total of five works sold in 2014 for a net total value of almost $1.7 million, all via auctions. The gross profit on these sales was $448'000, producing a 36% gross return and a very respectible IRR of almost 19%. The average hold period was circa 2.5 years.

![]()

For a succint overview of fund performance since inception, a correlation matrix, top holdings, realization table and much more please review and download/print our quarterly factsheet: Q4 2014 Factsheet

news archive

Global Lending Program

March 26, 2014—With 290 works by artists from over 30 countries the Tiroche DeLeon Collection continues to be an important source of information for art aficionados all over the world, as well as a preferred partner to several institutions to whom we are making repeat loans.

Read More »Artist Spotlight: Yan Pei-Ming

Oct. 23, 2019—We spotlight contemporary Chinese artist Yan Pei-Ming.

Read More »Art Vantage PCC Limited on Bloomberg

Sept. 1, 2013—We're proud to announce that the fund has been listed to Bloomberg

Read More »