Manager Update - Q1 2019

08.04.2019—

Dear Readers,

This quarter financial markets have staged a remarkable recovery after the big drop in Q4 2018. The S&P 500 climbed 12% to a high of 2855 on March 21, only 2.6% below its all-time high of 2930 in September 2018. I remain as convinced as before that a substantial drop is on the horizon, acknowledged finally by a change in stance by the Fed and the fixed income market that has inverted the yield curve in the last few days of the first quarter, a classic signal of a forthcoming recession.

_large.jpg)

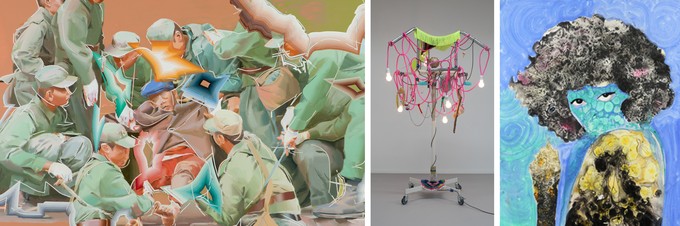

Sotheby's Hong Kong. L:R He Xiangyu, Cola Project, Wang Xingwei, Untitled (Small Begging), Chen Fei, See For Yourself.

Q1 ART AUCTIONS

Generally, the art auction market was in cautious mode in the first quarter, showing solid results on significantly lower volumes, a typical protective measure taken by auction houses as soon as the market softens. Sotheby’s Hong Kong auctions were the exception, where the Contemporary sale series was the largest ever staged in Asia.

- March Postwar & Contemporary London auction totals were down 26.4% vs. 2018. The underwriters of the market (those that provide the auction guarantees for big ticket items) reduced the total guaranteed amount by over 20%. (source: ArtTactic)

- Evening sale Bought-in (BI) rates were 7% at Christie’s, 9% at Sotheby’s and 17% at Phillips, averaging 10.3%. The same statistics for the day sales are 16%, 26% and 19% respectively, averaging 20.8%. The auction house’s selection bias and low estimate strategy worked again, maintaining sell through rates of close to 80% in the day sales.

- On April 1st however, on the back of a buzzing Art Basel Hong Kong, Sotheby’s HK staged an amazing series of Contemporary sales, grossing the highest total ever for a Contemporary sale series in Asia – USD 102 million. The sale through rate was very high and some incredible new auction records were set, led by a KAWS (Simpson) painting selling for the unthinkable amount of $14.8 million; a Kusama net painting for $8 million and a Julie Mehretu painting for $5.6 million. We took advantage of the frenzy by selling a group of works… read more below.

Art Market experts are growing more skeptical.

- In the Artnet Spring 2019 report, Tim Schneider writes a piece titled “What to expect in the art market… when you’re expecting a recession”. His opening paragraph: “Nothing gold can stay… beneath the big money rumblings… it wasn’t hard to hear a consistent, if sotto voce, stream of concern about a looming market downturn. The chatter only grew louder… many in the trade remain wary about the near future. Another decline is inevitable. When it will begin, and how harmful it will be, remain open questions.” He went on to give three tips to sellers in a down market: 1) don’t be afraid to sell a masterpiece (that is if you have something worth at least $25 million); 2) If you must sell during an art market slowdown, your best bet is in the $100k - $1 million price range, and 3) Think global (be smart about placing the right work in the right market).

- In the same Artnet report, another piece by Julia Halperin looking at stats, concludes that the art market is in a precarious position and is a trophy hunting market. Over the past 5 years the number of works offered at auctions has deciled by approximately 30% while overall turnover has been flat, which puts undue pressure on prices to rise and is unsustainable. In the decade ahead she claims the art market is unlikely “to see the same dizzying growth spurts it has enjoyed over the past few decades”. Contemporary grew the most in 2018, by 23.7.% in the 1-10 Million price bracket, the amrket's sweet spot.

- The ArtTactic report on the March Contemporary day sales in London takes a closer look at artists aged up to 45. Painting a similar picture it assigs the results to a more conservative approach by auction houses and reveals interesting trends. Whereas overall sales turnover is down 25%, sales of under 45s is down 45%. Female artists in this age group saw their share of sales grow from 15% in the March 2018 auctions to 22% in March 2019.

SALES ACTIVITY:

L:R He Xiangyu, Sorry Color in Red and Cola Project. Haegue Yang, Nosy Clown and Xie Nanxing, Postcard Tree.

At Art Vantage we took advantage (still love the pun!) of the first quarter and the above trends to sell a number of works via auctions in NY, London and Hong Kong, as well as one privately to a European Museum. We are proud to have achieved new world auction records for 3 female artists – Firelei Baez, Haegue Yang and Cui Jie; and matched the existing auction record of He Xiangyu.

Cui Jie sells for $30,000 and Haegue Yang for $71,000 at Sotheby's HK; Firelei Baez achieves $35,000 at Sotheby's NY.

WORKS FROM THE COLLECTION CURRENTLY ON MUSEUM LOANS:

While we focus more on our sales activity this quarter, we continue to promote works from the collection via active institutional loans. The following works from the collection are currently on view around the world:

- 2 works by Rina Banerjee at the Pennsylvania Academy of the Fine Arts in the US, until March 31

- Erika Verzutti at the Centre Pompidou in France, until April 15

- Yu Honglei at K11 Art Foundation in Hong Kong, until May 13

- Firelei Baez at Para Site Hong Kong, until June 9

- 3 works by Turiya Magadlela at Macaal Museum in Marrakesh, Morocco, until September 22

Erika Verzutti, Minerals, installation view at Centre Pompidou

2018 VALUATION, NAV CALCULATION & REALIZED RETURNS:

In March we received our 2018 year end collection valuation by one of the leading global auction houses. The valuation is provided as a service and is undertaken on a desktop basis. It is based on current auction estimates when the department experts feel there are sufficient comparable works in previous auctions, and when such don’t exist (almost half the works in the current valuation) the value provided is our acquisition price (from several years ago). Combining stale primary market prices acquired with an unusually high discount on one hand, with conservative auction estimates (sign of the current market conditions) on the other, unsurprisingly results in a very low valuation. In addition, our accounting methodology uses an assumed increase of 9% per annum to the artwork portfolio, straight-lined at 0.75% per month from January to November month end. The December Net Asset Value which is driven mostly by the valuation, therefore shows a substantial decline of - 21%, which translates to a 2018 full year decline of -16%. Interestingly, the MSCI Emerging Market index also dropped 16% in 2018. This is quite unsatisfactory of course, but fortunately is a theoretical, on paper, result.

Our actual results since this valuation are much more encouraging and demonstrate how conservative the 2018 valuation actually is. So far in 2019 we sold 15 works for a cumulative $774’000, representing a 21% premium to the 2018 valuation for the same group of works. The premium grows to an astounding 45% if we account for the 25% buyer premium on the works sold at auction. Remarkable. Our Gross IRR of 7.5% for this group is lower than our average Gross IRR on the $8.1 million of artwork sales since inception, which stands at 16.70%.

We will continue to focus efforts on selling for the remainder of the year, while the market remains receptive, and are already in process of consigning works for private sales through galleries, auction houses and art fairs and in public auctions through individual as well as group placements.

I look forward to reporting further on those efforts in our next newsletter and remain, as always, available to answer any questions.

Best regards and I hope to catch up with some of you in NY and Oslo in early May (frieze/1-54) and London and Basel in June.

Serge Tiroche, co-founder

news archive

BENTU at Fondation Louis Vuitton

Feb. 9, 2016—We are proud to announce that 6 out of 12 artists selected for Bentu are from the Tiroche DeLeon Collection.

Read More »Spotlight on India

Jan. 7, 2015—Following a weak period for the Indian contemporary art market, signs of recovery are emerging.

Read More »Manager Update - 2016 Q2

July 6, 2016—A quarterly update by Serge Tiroche about the state of the art market and activites of the Tiroche DeLeon Collection

Read More »