Manager Update - Q1 2018

04.04.2018—

Dear readers,

In my last newsletter from Jan 21st, I opened with remarks on the bullish sentiment in financial markets and cryptocurrencies and why it felt to me like “a major correction is on the horizon." Since then the Dow has dropped circa 8% and Bitcoin (the least volatile of cryptocurrencies) plunged 40%. I also said the correction would be “starting off in capital markets with possibly a spillover to the art market if the correction persists.” So far, the art market seems to be holding up fairly well judging by the recent spate of London and Hong Kong auctions.

NY auctions are next up in May and some major sales are expected, particularly at Christie’s who will be auctioning for charity the Peggy and David Rockefeller Collection. Even if financial markets transition from the current ‘correction’ to official bear market territory, this sale should do very well. What happens after that is what I am extremely curious, and cautious about.

In this light, it makes sense for the fund to try to sell works that have matured and where the markets for those artists are robust. We are trying to do that with certain works via private placement, direct selling and auctions.

Our most significant attempt at direct selling took place at Art Stage Singapore at the end of January. It is no secret that Art Stage has been experiencing declining stats in terms of both gallery and visitor participation in the past few years, a direct result of the hype on which it was founded in 2011 with huge support from local government, which has since dwindled. This presented an opportunity for us to receive the largest booth at the fair to present a curated exhibition of highlights of our South Asian collection. Our booth was consistently praised for the quality of the works - “nothing short of exceptional” one journalist wrote. Despite our PR ahead of the fair and big letter text explaining the concept of a curated selling exhibition at the booth itself, the idea of a “Collection” (even if owned by an Art Fund) selling at an art fair was received with a healthy dose of skepticism. Nonetheless, the works attracted several offers from a handful of serious collectors that showed up, but most were 20-30% below our asking price. Such collectors, particularly in Asia, are used to receiving these levels of discount in the primary market when galleries have a 50% margin to work with. Unfortunately, in our case such deep discounting does not make sense, so we had no sales. There were very few entry level collectors who could appreciate, let alone afford, the works at our booth. As Art Stage felt weak in terms of sales for most galleries we interviewed, we are not yet ready to give up on art fairs for direct selling.  Tiroche DeLeon Collection selling exhibition at Art Stage Singapore 2018

Tiroche DeLeon Collection selling exhibition at Art Stage Singapore 2018

On the selling front we also placed a couple of works in the 2nd African art auction at Sotheby’s London on March 28. We sold 2 works for circa $45'000. A Romuald Hazoume mask generated a healthy 15.4% IRR whereas a typical Ablade Glover market scene generated an exceptional 57% IRR, setting a New World Auction Record for the artist.

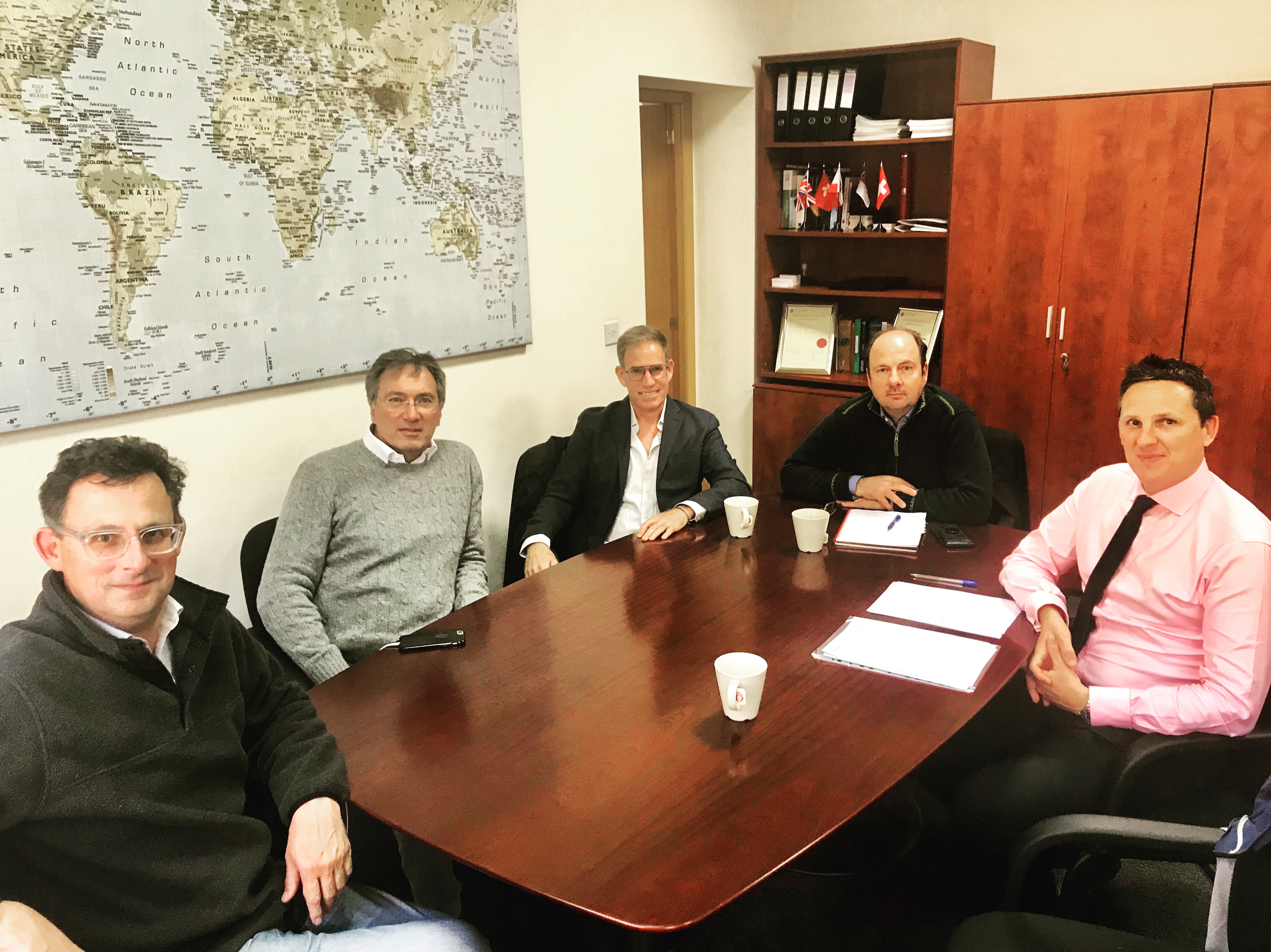

In early March I spent a few days in Gibraltar for our annual in-person board meeting. The Board reviewed the fund’s activity, year-end valuation, regulatory framework, performance and financial reports and the overall state of the art market. We also spent significant time discussing the potential effects of Brexit and Gibraltar’s bid to become Europe’s first regulated exchange for crypto-currencies and ICOs and further down the line securitized token issuance. The Gibraltar Stock Exchange (GSX) set up a subsidiary called the Gibraltar Block-chain Exchange (GBX). In preparation for this GSX acquired Grant Thornton’s Fund Administration business (administrators of Art Vantage PCC LIMITED among others) and changed their name to Juno Services. They then issued their White Paper for the creation of GBX and raised $29 million via a new Token called Rock. The GBX platform is currently in Beta and should start trading operation in Q2. By Q4 their plan is to be able to complete the first securitized token sales. This presents a compelling opportunity for Art Vantage to raise additional capital and potentially offer existing investors early liquidity. Thanks to our long standing relationships in Gibraltar we could benefit from being one of the first companies in line to raise capital via this democratizing platform. We are currently spending significant time studying and analyzing the opportunity and will inform our readership of our plans when they become clear. Block-chain is here to stay and it will have widespread impact on multiple markets, with the financial and art markets being prime candidates for rapid advancement.

Art Vantage board meeting in Gibraltar (left to right: Peter Haynes, Ariel Seidman, Serge Tiroche, Christopher Vujnovich, and Adrian Hogg).

Art Vantage board meeting in Gibraltar (left to right: Peter Haynes, Ariel Seidman, Serge Tiroche, Christopher Vujnovich, and Adrian Hogg).

Best wishes,

Serge Tiroche, co-founder

news archive

Artist Spotlight: Cui Jie

July 2, 2018—The Tiroche DeLeon Collection is proud to dedicate this next artist spotlight to Cui Jie, former Artist in Residence at the Tiroche DeLeon Collection & ST-ART residency in Israel (November 2015).

Read More »First long term Museum loan

April 2, 2013—We are very pleased to announce our first long-term, 7 year loan, of Shilpa Gupta’s stunning work from 2010, “I Keep Falling At You”, to the ZKM.

Read More »Artist Spotlight: Liu Shiyuan

July 5, 2016—Liu Shiyuan has cultivated a unique and tech-savy aesthetic ideology that bestows upon her art the air of a millenial prophet.

Read More »